The lack of cars out there to retail clients –

brought on by the pandemic and semiconductor scarcity – has resulted

in shoppers walking away from their favored manufacturers in document

figures. The url among loyalty and days’ source is extremely strong,

and as inventories have fallen, so has loyalty.

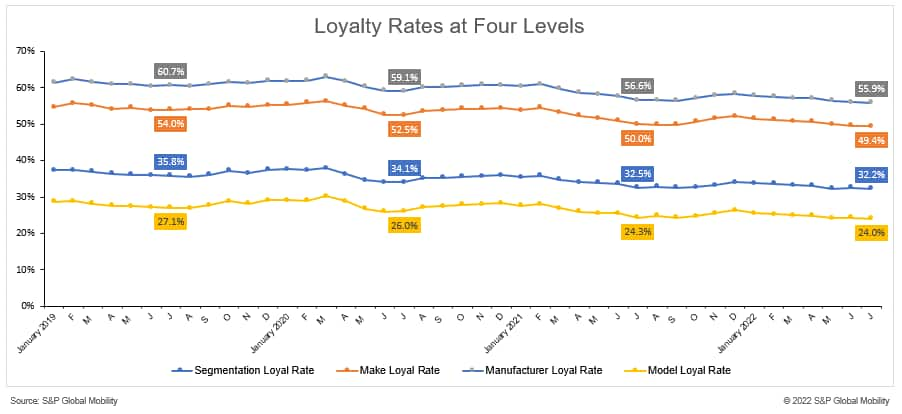

New car registration details point out that household loyalties

at 4 strata – maker, model, segment, and product – all are

at their cheapest stages since at the very least the start out of 2019, in accordance

to an S&P World-wide Mobility investigation.

Car or truck registration info for July 2022 – the most current knowledge

out there – marked the third consecutive thirty day period in which homes

returning to market place were being more very likely to defect than stay loyal to

the brand in their garage.

Field-huge model loyalty in July was just 49.4%, the cheapest

of any month in a few many years. Company loyalty of 55.9% also was

the most affordable any-month level for the period.

Section loyalty retreated to just 32.2% in July, down from 35.8%

a few several years ago, when product loyalty of 24% is down a lot more than three

proportion details from 3 years ago. Each figures had been the

cheapest any-thirty day period outcome in this time span.

As a end result, proprietors who manufacturers and dealers belief to return for

the exact same car or truck – and who have returned in the previous – now

are defecting at a greater rate than they are returning. That places

a brand’s market place share and a dealer’s income at threat. It is

incumbent on brands and dealers to proactively get to out to their

operator bases to lessen defections.

But these elevated defection costs also are an prospect for

automakers presently observing a return to more robust inventories. OEMs

and sellers can get advantage of this landscape by reaching out to

the acceptable audiences to attract these additional migratory

homes. If a new or re-created design is arriving with a

more robust products or price proposition than its opponents, in

ample quantities, this could be key time for conquesting

prospects.

—————————————————————————————–

This automotive insight is portion of our month-to-month Top rated

10 Trends Marketplace Report.The Report conclusions are

taken from new and applied registration and loyalty data.

The September report is now obtainable, incorporating July 2022

CFI and LAT data. To obtain the report, please click on below.

Obtain REPORT

This short article was published by S&P World wide Mobility and not by S&P World-wide Rankings, which is a separately managed division of S&P World wide.

Best New Car Ratings for Safety and Reliability

Best New Car Ratings for Safety and Reliability  Exploring the Top Picks: Unveiling the Best Car Models

Exploring the Top Picks: Unveiling the Best Car Models  Unveiling Excellence: The World of In-Depth Car Reviews

Unveiling Excellence: The World of In-Depth Car Reviews  Inside the Dynamic Car Industry

Inside the Dynamic Car Industry  Unveiling Current Auto Trends

Unveiling Current Auto Trends  Exploring the Latest Motor Trend Updates

Exploring the Latest Motor Trend Updates  Smart budgeting strategies for tradespeople

Smart budgeting strategies for tradespeople  Exploring New Car Ratings: A Comprehensive Insight into Automotive Excellence

Exploring New Car Ratings: A Comprehensive Insight into Automotive Excellence  Vintage Ring Settings Loved by London Couples

Vintage Ring Settings Loved by London Couples