The biggest challenge for OEMs rolling out new battery electric

vehicles (BEVs) is mounting enter fees, which are affecting cost

parity with customarily run autos. With prices of important uncooked

elements made use of in BEVs having risen drastically due to the fact 2019,

S&P World-wide Mobility sees the probable for alterations in buyer

behaviour, whilst the projected prolonged-expression market share of BEVs is

probable to be unchanged.

- All round, we count on 2022 to be a yr when growing raw product

rates peak. However, we also anticipate automakers to be functioning with

important raw elements prices about 75% larger in 2030 than in

2019. Our forecasts for car gross sales, powertrains, and elements

now replicate the effects of that expectation. - In terms of the present make-up of the worldwide passenger vehicle

marketplace, we be expecting two big issues for automobiles powered by

classic ICE technological innovation. To start with, stricter emissions polices

will increase the price tag of motor vehicle know-how and emissions

controls. Next, in the change to electrification, with

decreasing volumes of ICE autos towards rising volumes of

BEVs, this will erode the economies of scale of ICE autos and

in all probability boost their price foundation. - Prior to the increase in crucial raw components charges, some rate

parity of BEVs with ICE and hybrid types experienced been anticipated by

about 2025, excluding cars in entry-rate-issue segments. Such

parity would likely final result in some OEMs leaving the city motor vehicle

phase and more and more narrowing solutions in conditions of entry-amount

A-phase vehicles.

Market place dynamics may see some transform

- S&P World Mobility does not anticipate the pricing pressures

to have much affect on motor vehicle profits at the topline, regardless of

expectations that more compact car segments will keep limited BEV

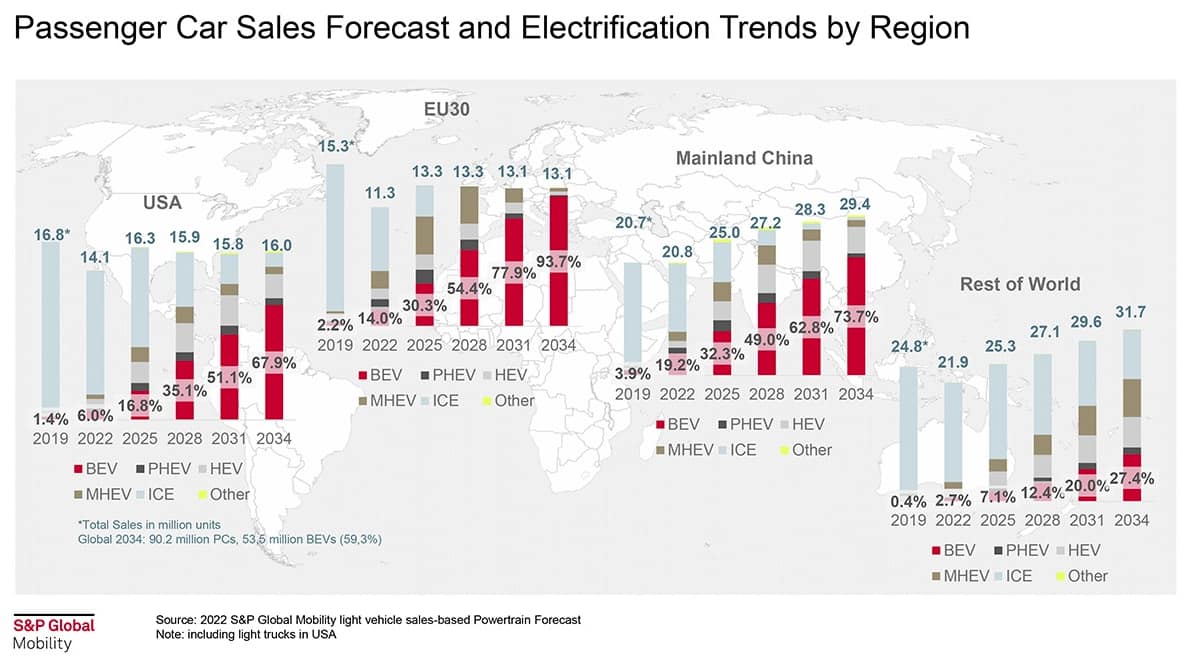

selections as a outcome. In 2031, our newest forecast sees BEVs

reaching a 51.5% sector share in the United States, virtually 78% in

Europe, and about 74% in China. Nevertheless, the relaxation of the globe is

predicted to carry on to lag and BEVs to have a market share of only

about 27%.

- OEMs have some resources accessible to them to retain BEV fees in

verify. These include things like switching to less-highly-priced lithium iron

phosphate (LFP) battery chemistries. Just one most likely intriguing

but untried option for running residual values and lease costs is

a Toyota proposal for manufacturing facility refreshing of made use of cars and trucks. OEMs could

also opt to reintroduce intense auto reductions, but in the

previous few many years, the field has been going away from doing

this. - For customers, there are also options. Initially, we will see a

degree of acceptance of price tag improves. Customers are most probably

to acknowledge rate raises when they are in the sort of average

lease fees for considerably less-value-sensitive purchasers. Yet another result may possibly be

consumers switching to lower-positioned brand names or segments.

Shoppers could also boost the keeping period of time of a vehicle or choose

to leave the new-motor vehicle industry. Both of all those possibilities have the

possible to influence topline sales volumes around time, even so.

This report was released by S&P Worldwide Mobility and not by S&P International Rankings, which is a separately managed division of S&P Worldwide.

5 Common Car Problems You Should Be Prepared for

5 Common Car Problems You Should Be Prepared for  What Makes Dunlop Tyres The Best Choice For Drivers In Dubai?

What Makes Dunlop Tyres The Best Choice For Drivers In Dubai?  The Different Types Of Cooper Tyres Available In Dubai

The Different Types Of Cooper Tyres Available In Dubai  The Latest Continental Tyre Technologies In Dubai

The Latest Continental Tyre Technologies In Dubai  TOM’S Angel T01: As Rare & Real As It Gets

TOM’S Angel T01: As Rare & Real As It Gets  Smart budgeting strategies for tradespeople

Smart budgeting strategies for tradespeople  Exploring New Car Ratings: A Comprehensive Insight into Automotive Excellence

Exploring New Car Ratings: A Comprehensive Insight into Automotive Excellence  Vintage Ring Settings Loved by London Couples

Vintage Ring Settings Loved by London Couples