Rivian Automotive’s (NASDAQ:RIVN) short percent of float has risen 8.41% due to the fact its very last report. The business just lately described that it has 55.92 million shares sold shorter, which is 11.47% of all common shares that are readily available for investing. Based on its buying and selling quantity, it would get traders 2.8 days to include their shorter positions on average.

Why Brief Desire Issues

Brief interest is the selection of shares that have been bought shorter but have not nevertheless been covered or closed out. Limited offering is when a trader sells shares of a organization they do not personal, with the hope that the cost will drop. Traders make income from short offering if the selling price of the stock falls and they eliminate if it rises.

Shorter desire is essential to keep track of for the reason that it can act as an indicator of sector sentiment toward a particular inventory. An boost in quick interest can signal that traders have develop into a lot more bearish, when a minimize in quick curiosity can signal they have become additional bullish.

See Also: Listing of the most shorted stocks

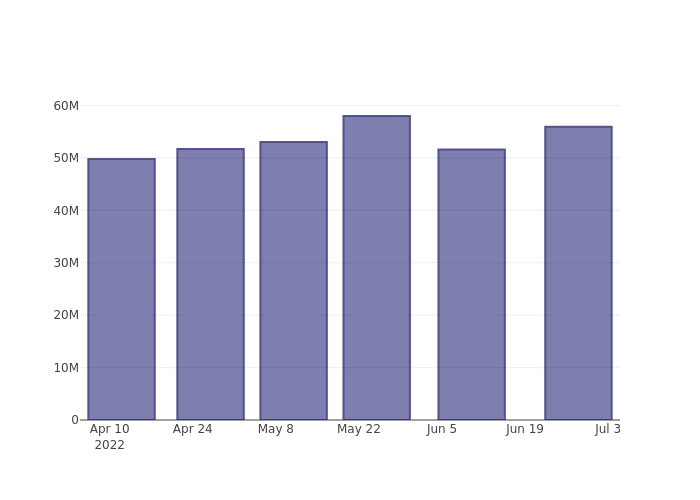

Rivian Automotive Small Interest Graph (3 Months)

As you can see from the chart higher than the proportion of shares that are offered quick for Rivian Automotive has developed because its past report. This does not indicate that the stock is heading to slide in the in close proximity to-time period but traders should really be mindful that a lot more shares are remaining shorted.

Comparing Rivian Automotive’s Shorter Interest Towards Its Peers

Peer comparison is a preferred strategy among analysts and investors for gauging how very well a organization is undertaking. A company’s peer is one more business that has equivalent qualities to it, these as field, sizing, age, and economic composition. You can discover a firm’s peer group by reading through its 10-K, proxy filing, or by executing your personal similarity investigation.

According to Benzinga Pro, Rivian Automotive’s peer team ordinary for short fascination as a proportion of float is 16.77%, which signifies the business has considerably less shorter curiosity than most of its peers.

Did you know that expanding limited curiosity can essentially be bullish for a stock? This write-up by Benzinga Income points out how you can earnings from it..

This article was produced by Benzinga’s automatic content material motor and was reviewed by an editor.

5 Common Car Problems You Should Be Prepared for

5 Common Car Problems You Should Be Prepared for  What Makes Dunlop Tyres The Best Choice For Drivers In Dubai?

What Makes Dunlop Tyres The Best Choice For Drivers In Dubai?  The Different Types Of Cooper Tyres Available In Dubai

The Different Types Of Cooper Tyres Available In Dubai  The Latest Continental Tyre Technologies In Dubai

The Latest Continental Tyre Technologies In Dubai  TOM’S Angel T01: As Rare & Real As It Gets

TOM’S Angel T01: As Rare & Real As It Gets  Smart budgeting strategies for tradespeople

Smart budgeting strategies for tradespeople  Exploring New Car Ratings: A Comprehensive Insight into Automotive Excellence

Exploring New Car Ratings: A Comprehensive Insight into Automotive Excellence  Vintage Ring Settings Loved by London Couples

Vintage Ring Settings Loved by London Couples