The U.S. Treasury Division on Friday introduced an update on how autos will qualify as a motor vehicle or an SUV less than the revamped EV tax credit history, now regarded as the thoroughly clean car tax credit.

For EV customers it is superior information, as it will obvious up a bewildering and seemingly arbitrary dividing line in which some variations of particular models—like the Tesla Model Y—were manufactured suitable at a increased MSRP though some others weren’t.

The new credit established under the Inflation Restoration Act incorporates a range of modifications, together with earnings caps, as well as domestic sourcing rules not however enforced. But it also sets cost caps for qualifying EVs, of $55,000 for new cars and trucks and $80,000 for pickup vans, SUVs, and vans.

So considerably that’s been one particular of the most fraught for consumers. Simply place, some versions categorised as SUVs on their window stickers had been currently being limited to the $55,000 cap.

2023 Volkswagen ID.4

What improvements: Search at the window sticker

To make it easier for shoppers to know which cars qualify less than the relevant MSRP cap, Treasury is updating the car classification regular to use the buyer-experiencing EPA Gasoline Financial state Labeling common, alternatively than the CAFE (corporate average fuel economy) standard.

“This transform will permit crossover automobiles that share similar attributes to be treated constantly,” stated the Treasury Department in a launch. “It will also align car classifications less than the thoroughly clean automobile credit with the classification shown on the vehicle label and on the purchaser-struggling with website FuelEconomy.gov.”

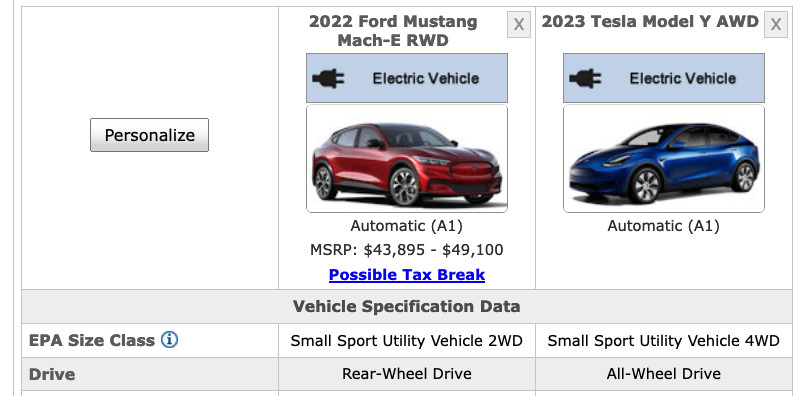

Ford Mustang Mach-E and Tesla Model Y instance for EPA course

Buyers can locate the EPA classification of a automobile at FuelEconomy.gov, and clicking the “Specs” tab. For instance, the Tesla Design Y and Ford Mustang Mach-E lineups are both equally categorized as “Small Sport Utility Vehicle” by the EPA—making distinct that they would now be qualified.

And to underscore this, the IRS had presently, on Friday morning, up-to-date its listing of qualifying cars and their respective selling price caps.

How this took place

For the sake of clarity, it’s a superior transfer. So how did this take place in the first area?

The Treasury Department resolved to use the definition between car and SUV with historic precedence. Below that, SUVs with a gross car or truck fat underneath 6,000 kilos are lumped with vehicles only if they have 4-wheel drive (or all-wheel drive).

It dates back to the 1970s—well right before SUVs were any sizeable market place classification of passenger vehicles—and it hasn’t been current substantially because then.

This regulatory difference among cars and SUVs is only now employed to calculate corporate average fleet gasoline economic climate (CAFE)—a compliance obligation, and a gauge by regulators on how well the market is undertaking in trying to keep up on effectiveness and emissions specifications. But the list of automobiles that variable into CAFE as automobiles or vans, and why, isn’t laid out any where obviously everywhere in a sort buyers can comprehend.

2022 Ford Mustang Mach-E

Even more, the application of the CAFE difference in between automobiles and SUVs does not offer significantly of a useful distinction concerning car kinds and how they might truly be shopped or utilised.

So the use of it for the EV tax credit rating fundamentally threw down a dividing line down in the middle of the SUV discipline, penalizing lighter models with two-wheel drive, although gratifying heavier types with all-wheel travel, far more seats, and perhaps effectiveness choices.

Indeed, it is retroactive—to January 1

The Treasury Section states that individuals who put a auto in assistance (took delivery) since January 1, 2023, that qualifies beneath the new definition and satisfies all the other credit needs will be in a position to declare it—even if the motor vehicles didn’t qualify up until right now.

With this clarity on motor vehicle styles qualifying for particular cost caps, the Treasury notes that another update is coming. Steerage on U.S. sourcing for essential minerals—an area of the tax credit rating not however currently being enforced—is due to be issued in March, and it’s very likely to narrow the discipline appreciably for EVs that qualify for the whole credit score.

Best New Car Ratings for Safety and Reliability

Best New Car Ratings for Safety and Reliability  Exploring the Top Picks: Unveiling the Best Car Models

Exploring the Top Picks: Unveiling the Best Car Models  Unveiling Excellence: The World of In-Depth Car Reviews

Unveiling Excellence: The World of In-Depth Car Reviews  Inside the Dynamic Car Industry

Inside the Dynamic Car Industry  Unveiling Current Auto Trends

Unveiling Current Auto Trends  Exploring the Latest Motor Trend Updates

Exploring the Latest Motor Trend Updates  Smart budgeting strategies for tradespeople

Smart budgeting strategies for tradespeople  Exploring New Car Ratings: A Comprehensive Insight into Automotive Excellence

Exploring New Car Ratings: A Comprehensive Insight into Automotive Excellence  Vintage Ring Settings Loved by London Couples

Vintage Ring Settings Loved by London Couples