Plug-in hybrids are a excellent way to adapt to the electrical-vehicle long run without the need of obtaining to rely on it, chilly turkey. People contemplating plug-in hybrid styles this 12 months have a range of far better products alternatives than in former years—with longer electric powered variety, superior drivability and more off-road capability.

Yet instantly, far fewer of them are producing as much economical perception compared to hybrids, because of to the abrupt reduction of the federal EV tax credit rating for many of the market’s PHEVs right after President Biden signed the Inflation Reduction Act (IRA).

2021 Jeep Wrangler 4xe

The revamped credit beneath IRA, named the Thoroughly clean Motor vehicle Credit history, only applies to plug-in hybrids and EVs that are American-built. And with the exception of a handful of PHEVs from Chrysler, Ford, Jeep, and Lincoln, as well as a couple of far more select styles from Audi, BMW, and Volvo, EV tax credit history eligibility has been considerably slash.

Do your calculations on expense, gasoline, energy

Right until not long ago, plug-in hybrids have been a sensible alternative if you price minimal operating prices and the best in general value—while maximizing battery sources and building, in most situations, a greener alternative as opposed to hybrids.

Loren McDonald, founder and main analyst of the consultancy EVAdoption, cites the Kia Niro Plug-In Hybrid as an illustration. It previously experienced for a $4,585 tax credit history, approximately negating the $4,900 cost variance with the Niro Hybrid. But now? Nicely, it is dependent on irrespective of whether or not you however may well be qualified for point out or even area incentives applying to plug-in hybrids.

“Opting for the PHEV variation may have been a no-brainer for many consumers,” McDonald notes, when including in state and utility incentives, moreover decrease fuel expenditures, but now it will need extra thing to consider.

While it’s undoubtedly too early to inform based on market place details, there might be cases the place prospective consumers transform about and get a hybrid in its place.

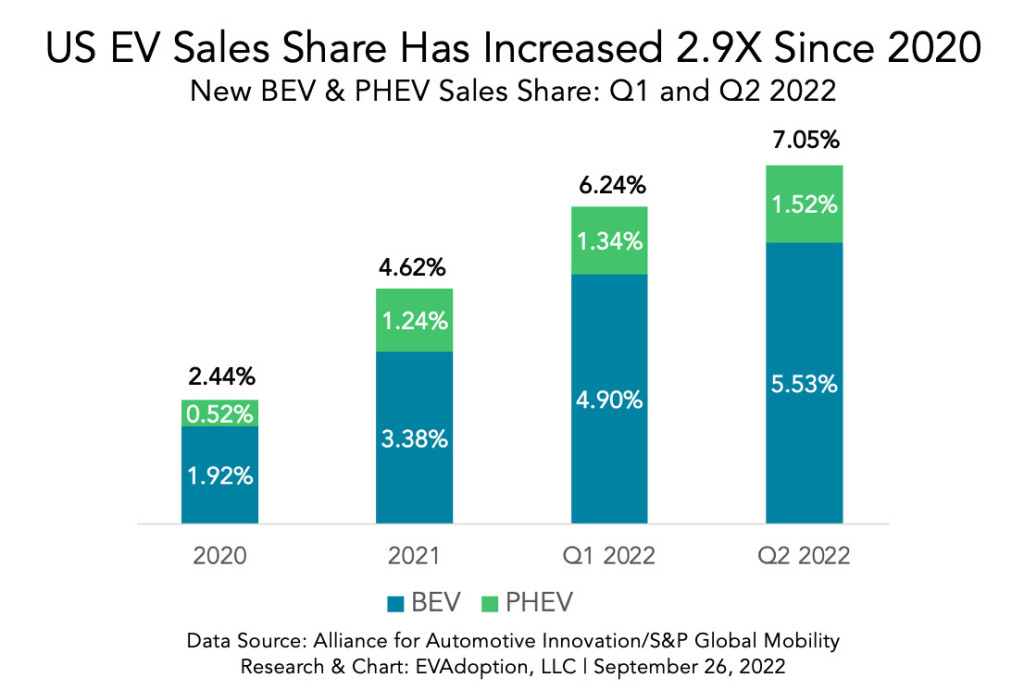

U.S. EV and PHEV gross sales share – EVAdoption

PHEVs have noticed steady progress along with EVs above the previous several several years. And even though EVs surface to be locked on to a fast-rise trendline, there’s not as potent a long-term prognosis for PHEVs. As of July—before the passage of the IRA—S&P expected that in 2030 just 5% of U.S. new vehicle revenue would be plug-in hybrids, versus 47% thoroughly electrical cars. Which is up from the 1.5% PHEVs and 5.5% EVs expected by EV Adoption for the 2nd quarter of 2022.

No tax credit score, still PHEV sticker costs rising?

There have been a couple of plug-in hybrid current market introductions in recent months, and the pricing decisions have been a bit astonishing. Even with the loss of the tax credit, these selling prices on newly ineligible PHEVs have absent up as opposed to suitable predecessors.

Mitsubishi verified one particular such illustration this previous 7 days. Its 2023 Outlander Plug-In Hybrid will start off at $41,190, together with the necessary $1,345 place price. That’s up approximately $3,000 in sticker price tag, from $38,240 for 2022.

In base-line money for most purchasing homes, the Outlander PHEV is up much more than $9,500 as opposed to last year. The Outlander PHEV used to be eligible for the federal EV tax credit—an amount of $6,587 based on its battery capability. The 2023 model, with its more substantial 20-kwh battery pack, would have been suitable for the total $7,500 total had it achieved the industry prior to the August 16 signing.

2023 Mitsubishi Outlander Plug-In Hybrid

As we claimed in a initial travel of the Outlander PHEV, this model’s greater battery, much better electric motors and expanded electric-only procedure supply an great 38 all-electric miles of operation moreover a seamless changeover in between electric power resources in hybrid method. It represents the finest know-how from the Japanese model and is a sturdy substitute to the Toyota RAV4 Primary, ideal that vehicle with an supplemental row of seats.

Kia also, since the tax credit score demise, hiked the base value of its Sorento Plug-In Hybrid by far more than $5,000 for 2023, vs . 2022. That roomy, a few-row model was also eligible for $6,587 beneath the outgoing EV tax credit score, that means that the 2023 Sorento PHEV, at $51,185, now fees about $11,600 extra than past year’s design. Which is for a “streamlined” lineup putting all the aim on the major-of-the-line SX-P trim, including all-wheel push, a suite of driver-guidance capabilities, and an AC inverter good for powering a laptop computer.

Will far more PHEVs be built in America?

Though Stellantis’ Jeep Wrangler 4xe and Chrysler Pacifica Hybrid are two of the prime-selling American-crafted plug-in hybrids for which the EV tax credit even now utilize, the consumers of the preferred Toyota RAV4 Key and Prius Key can no for a longer period declare it thanks to their Japanese assembly.

The decline of the EV tax credit score for imported types also consists of some of the PHEVs with the longest electric powered array, such as all but a person of Volvo’s Recharge PHEVs lately presented more substantial battery packs. While the XC60 Recharge PHEV we drove previous 12 months is among individuals counted out for their European assembly, Volvo’s South Carolina–built S60 T8 Recharge sedan, at 41 EPA-rated electric miles, is its sole PHEV that presently qualifies.

2022 Volvo XC60 Recharge

McDonald doesn’t see that the IRA will necessarily cause a shift of much more plug-in hybrids from foreign-built to American-manufactured. Which is due to the fact one of the key issues is not just the likely revenue volume that may make U.S. assembly worthwhile, but no matter if or not they can fulfill foreseeable future battery cell and mineral requirements as laid out for the Clear Motor vehicle Credit history.

“Since they are both of those providing at a substantial volume (from an EV point of view) and assembled overseas, they may not imagine it is truly worth the investment to change producing to North American factories,” he claims about the Toyotas.

California’s 50-mile requirement

In addition, the tighter rules from California—adopted by at least 9 other states—are another issue. They call for that PHEVs produce 50 miles of electric powered variety, commencing with the 2026 product calendar year, to receive the entire ZEV credit score amounts from the state’s Air Assets Board.

2023 Hyundai Tucson Plug-In Hybrid

That prerequisite could be a last straw for automakers, in phrases of the selection of PHEVs they can develop with larger batteries and included complexity while also incorporating extra thoroughly electrical styles, and it may possibly likely swing automakers that are currently incredibly bullish on PHEVs, like Hyundai and Kia, absent from them. They might as an alternative concentration on a several U.S.-sourced, U.S.-assembled EVs that would qualify and be more expense-powerful.

“Some automakers may possibly just use this prerequisite as a catalyst to exit the PHEV company and aim on frequent hybrids and complete BEVs,” stated McDonald.

Sector forces could correct this

Michael Fiske, affiliate director for powertrain forecasting at S&P International Mobility, suggested that the current market forces about very simple source and desire may well be limiting the development of PHEVs as a greener risk for some purchasers.

Need far outpaces provide, and it will for the next yr or so, said Fiske, inflating sticker price ranges and transaction selling prices. “These autos are positioned to be aggressive in the existing setting, and the latest setting is anything at all but standard,” he said.

“The brands, they have shareholders, and want to maximize their income, and that’s an straightforward way to do it,” Fiske included. “There’s no will need to attempt to price reduction it to check out to catch the attention of a lot more buyers since you are likely to be promoting out no make any difference what.”

Fiske explained there’s a sense inside of the business that the market place will normalize and costs might will need to come back down, but as some companies will qualify for the new credit rating and other people will not, pricing will be readjusted in different ways. As such, some automakers will make a decision that plug-in hybrid is a very good changeover technological innovation and other people won’t.

Product lineups will improve

How the mixture of the IRA and the California demands will affect plans for PHEVs vs. EVs continues to be to be viewed, and it is going to be a new and various calculation for each business.

“Manufacturers trying to figure out how to qualify or if it can be worthy of it anymore—that’s certainly going on,” Fiske explained. “But as perfectly, we still have a continuing semiconductor scarcity, and that is actively playing a important position, together with this over-all inflation.”

2023 Volkswagen ID.4

Some automakers, including Common Motors and Volkswagen, have a long time back made the decision that plug-in hybrids aren’t worth it for the U.S.

With an arguably significantly more advanced supply chain than EVs, involving engines, transmissions, battery packs, clutches, and numerous far more parts, shifts in plug-in hybrid producing seem fewer very likely in the in close proximity to future—pegging PHEVs as a lot less of the fiscally reasonable technological know-how bridge for automakers they may have after appeared.

The analysts we polled collectively claimed that the types to enjoy as this unfolds will be Toyota, Nissan, Hyundai, and Kia, all of which were at least mulling plug-in hybrids as a transitional tech toward much more EVs. With solution cycles of at least a few many years, it’s not going to be rapid.

Just a minor endurance?

In this present market place of limited provide and overheated need, it could just consider some persistence. Selling prices settling beneath market forces and incentives from California states might assist align PHEVs back to a location in which their working costs make more sense for more families.

“The IRA, when we glance at it holistically and not for the reason that of the present troubles in the current market, is heading to be more impactful on the types of decisions we’re seeing people make almost certainly closer to 2025-2026, when they can see that normalization of the sector,” predicted Fiske.

So really do not write off PHEVs as a excellent answer to assistance change motorists away from gas stations—but for yet another calendar year or two, the option might not be approximately as clear-slice as it was.

What to Do When Your Van Breaks Down: Insights from Breakdown Cover Experts

What to Do When Your Van Breaks Down: Insights from Breakdown Cover Experts  The Importance of Car Maintenance

The Importance of Car Maintenance  Watch a Rimac Nevera set two dozen speed and acceleration records in a day

Watch a Rimac Nevera set two dozen speed and acceleration records in a day  F1 Review: Miami 2023 – Double Apex

F1 Review: Miami 2023 – Double Apex  From the NewsVroom: New Nissan GT-R, Audi Activesphere, BMW M3 CS

From the NewsVroom: New Nissan GT-R, Audi Activesphere, BMW M3 CS  How To Adjust LED Headlight Bulbs?

How To Adjust LED Headlight Bulbs?  Smart budgeting strategies for tradespeople

Smart budgeting strategies for tradespeople  Exploring New Car Ratings: A Comprehensive Insight into Automotive Excellence

Exploring New Car Ratings: A Comprehensive Insight into Automotive Excellence  Vintage Ring Settings Loved by London Couples

Vintage Ring Settings Loved by London Couples